Deere’s Surprise Move to Buy the Wirtgen Group and what it means

With the planned purchase of the Wirtgen Group, the global leader in road construction equipment, Deere will add five premium brands to their construction equipment lineup with no product overlap

In an unexpected move, John Deere announced that they plan to buy the Wirtgen Group which would immediately expand their roadbuilding business worldwide and make them a top-three construction equipment business.

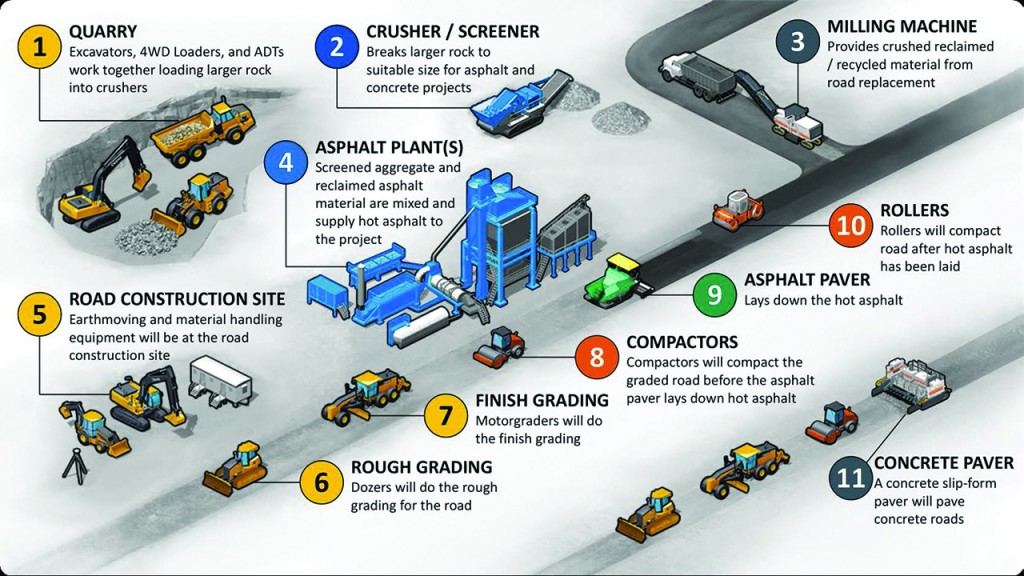

Wirtgen Group is a privately owned company based in Germany with well-known global brands, including Wirtgen, Hamm, Vogele and Kleemann - premium brands in road construction covering milling, processing, mixing, paving, compaction and rehabilitation. The company has approximately 8,000 employees and sells products in more than 100 countries through a large network of company-owned and independent dealers.

The company was founded in 1961 by Reinhard Wirtgen when he was only 19 years old. He and his wife Gisela built the company, which she took over when he was killed in a car accident in 1997. In 2007, she transferred the shares equally to their two sons, Stefan and Jürgen.

After 20 years as managing partners, Jürgen and Stefan decided to sell the company to John Deere. But why now and why Deere?

This deal was many years in the making as the brothers were thinking ahead about retiring and their children were too young to take on the business.

"You don't pass on your life's work without a great deal of thought," the brothers noted in an interview. "After all, this company has been the focal point for two generations of our family. We've put our heart and soul into it. But what mattered most to us was ensuring that the Wirtgen Group, along with its employees, would be able to endure over the long term, even when we are no longer active."

Jürgen Wirtgen made it clear that their "company's strength and success comes from dedicated employees who are focused on helping customers succeed in the road construction industry." The brothers wanted to protect their employees.

There were other potential buyers, with Wirtgen receiving on average one offer per year. Jürgen and Stefan said that they considered other options but that in the end, they concluded that it would be best for the company "to have a stable owner who knows the business, who understands the needs of the employees and customers, and who is fully committed to the company's long-term success.

"Right from the start we ruled out numerous interested parties, companies in our own sector because we didn't want to sell to competitors, as well as hedge funds and private equity companies because they couldn't have guaranteed a secure future for the Wirtgen Group. This considerably lowered the number of suitable candidates. When John Deere approached us about a year ago and we had our first talks, both sides immediately realized that it was a match."

Growth market

Deere says that Wirtgen's highly complementary product portfolio enhances Deere's existing construction equipment offering and establishes Deere as an industry leader in global road construction.

"Spending on road construction and transportation projects has grown at a faster rate than the overall construction industry and tends to be less cyclical," said Max Guinn, President of Deere's Worldwide Construction & Forestry Division. "There is recognition globally that infrastructure improvements must be a priority and roads and highways are among the most critical in need of repair and replacement."

Sam Allen, Chairman and Chief Executive Officer, Deere & Company commented that Wirtgen's superb reputation, strong customer relationships and financial performance made the company a good fit for John Deere's expansion of their construction equipment sales to more customers, markets, and geographies. "The acquisition of the Wirtgen Group aligns with our long-term strategy to expand in both of John Deere's global growth businesses of agriculture and construction," Allen said.

Deere expects that the combined business will benefit from the sharing of best practices in distribution, manufacturing and technology, as well as in the scale and efficiency of operations. Stefan Wirtgen noted that "the Wirtgen Group has a legacy of technology and innovation."

The purchase price for the equity is EUR 4.357 billion (USD 4.9 billion) in an all-cash transaction. The purchase is subject to regulatory approval in several jurisdictions as well as certain other customary closing conditions but the companies said they expect to close on the transaction in the first quarter of Deere's 2018 fiscal year.

Company info

6030 Dana Way

Antioch, TN

US, 37013

Website:

wirtgen-group.com/en-us

Phone number:

615-501-0600