Global Cement Consumption Set to Reach New Highs

International Cement Review has just released its latest Global Cement Report, a 400-page analysis and forecast for the worldwide cement industry, with coverage of over 160 countries in unmatched detail.

UK-based International Cement Review is recognized throughout the cement industry as the leading provider of detailed cement information for CEOs, managers, producers, traders and shipping specialists since 1988.

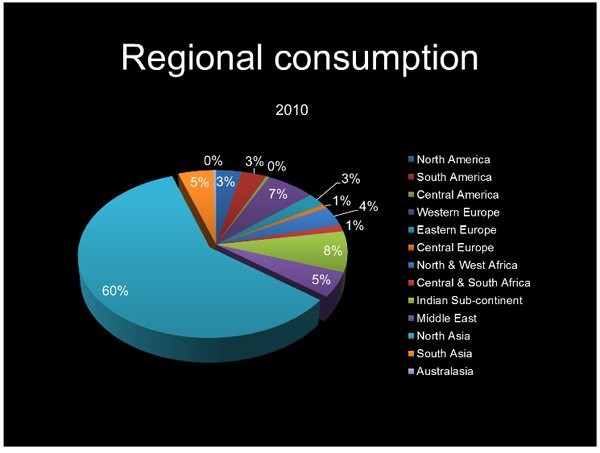

In essence, this new report notes that global cement consumption growth slowed by 2.4 per cent in 2008 to 2830Mt, but recovering thereafter to 2998Mt in 2009 and up to 3294Mt in 2010, giving annual growth rates of 5.9 per cent and 9.9 per cent, respectively, for these latter two years By 2012, worldwide cement consumption is forecast to reach a record 3859Mt.

China now dominates world cement statistics consuming 1851Mt in 2010, almost double 2004 levels, while India, the world's second-largest consumer registered 212Mt in 2010. The United States, the third-largest consumer, saw demand fall down to 69Mt.

World trade in cement and clinker was noted at 150Mt in 2010 of which seaborne trade was estimated at 105Mt. Some 50Mt of clinker was included in the above international trading totals.

Turkey is currently noted as the world's leading export nation of cement and clinker, with sales of 19Mt in 2010, overtaking China which recorded close to 17Mt of export sales. Thailand was third with 14Mt of cement and

clinker exports.

Bangladesh is currently the largest cement and clinker import nation worldwide with over 12Mt of deliveries in 2010 followed by Nigeria at 7Mt and the USA at close to 6Mt (down from 36Mt in 2006).

Lafarge retains its top position in terms of global cement sales of 141.2Mt and turnover of EUR15,884m ahead of Holcim with cement sales of 136.7Mt and a turnover of EUR15,691m. HeidelbergCement remains third, ahead of Cemex, Italcementi and Buzzi Unicem. Holcim, however has the lead in terms of global cement capacity at 212Mt, 11Mt higher than Lafarge.

The Global Cement Report also includes country-by-country cement forecasts, including consumption, production, exports and imports up to 2012.

This unique reference work is accompanied by an indispensable CD providing 20 years of statistical data in Excel format, arranged by country and geographical region.

The report is now available for immediate purchase from our website at:

http://www.cemnet.com/publications/GlobalCementReport9